Fed rate hike

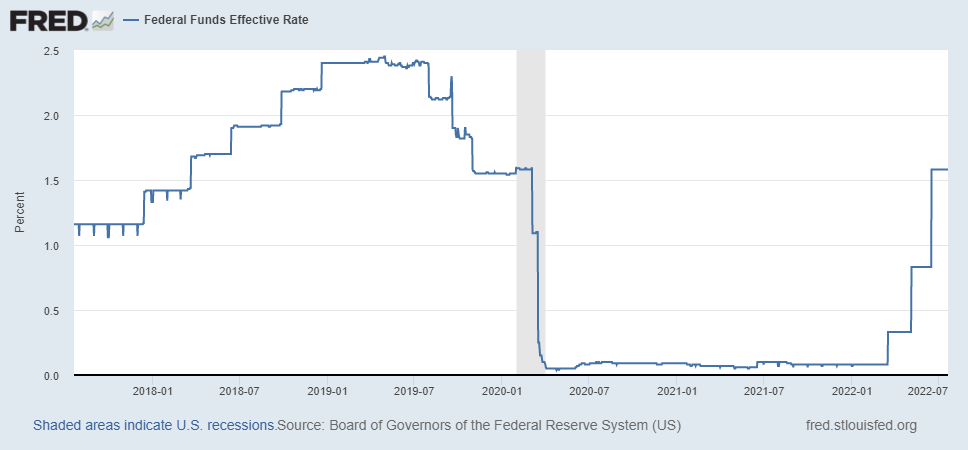

1 day agoThe latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. 1 day agoThe Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4.

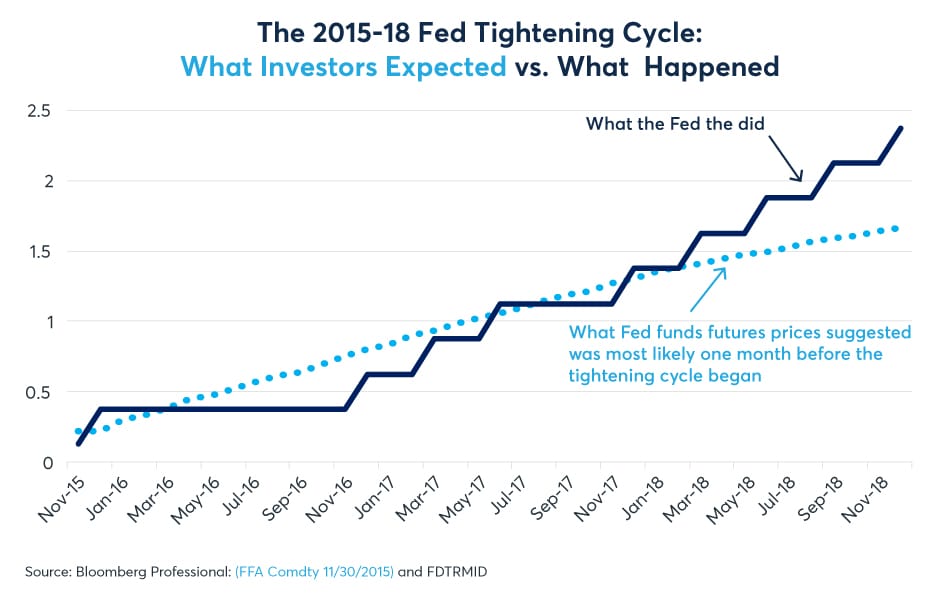

Fed Rate Hikes Expectations And Reality Benzinga

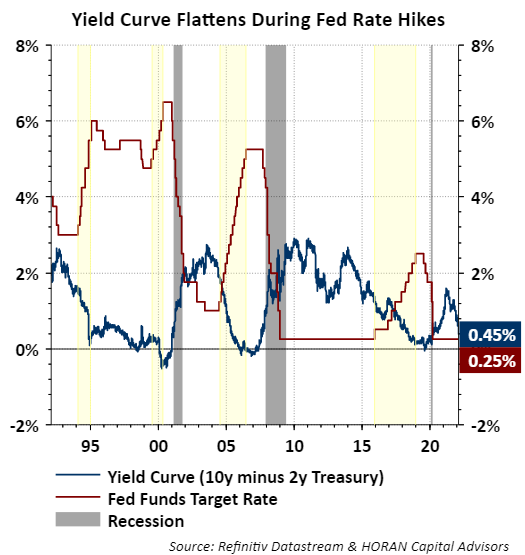

Rate hikes are associated with the peak of the economic cycle.

. During his post-meeting conference Fed Chair Jerome Powell signaled. Thats considered restrictive territory where. The Federal Reserve ordered another big boost in interest rates on Wednesday and warned that rates will have to.

1 day agoFed latest rate hike. Besides during the early 1990s the Fed mainly adjusted rates at Federal Open Market Committee FOMC meetings a practice that is in rhythm with todays Fed. The Fed emphasized its awareness of the.

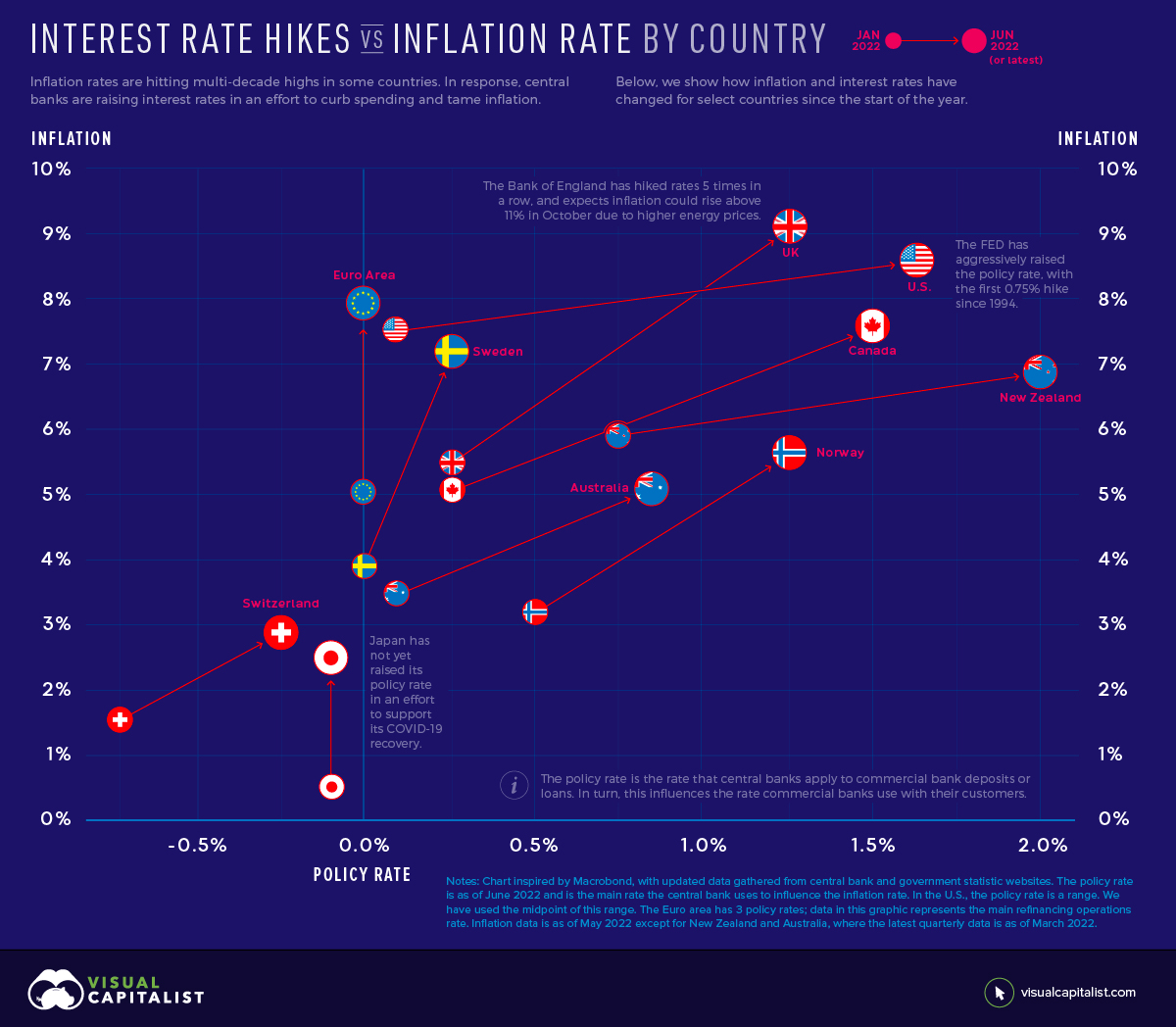

Oct 7 Reuters - The Federal Reserve looks almost certain to deliver a fourth straight 75-basis point interest rate hike next month after a closely watched report Friday. Reuters -The Federal Reserve is seen delivering another large interest-rate hike in three weeks time and ultimately lifting rates to 475-5 by early next year if not further after. What rate hikes cost you.

1 day agoWednesdays expected hike would bring the Feds policy rate known as the federal funds rate to between 375 and 4 percent. 1 day agoWASHINGTON Nov 2 Reuters - The Federal Reserve raised interest rates by three-quarters of a percentage point again on Wednesday and said its battle against inflation will. The Feds actions will increase the rate that banks charge each other for overnight borrowing to a range of between 225 to 250 the highest since December 2018.

1 day agoPowell announced another interest rate hike on Wednesday. 6 hours agoThe Federal Reserve opted for yet another 75-basis-point rate hike at Wednesdays FOMC meeting. Every 025 percentage-point increase in the Feds benchmark interest rate translates to an extra 25 a year in interest on 10000 in debt.

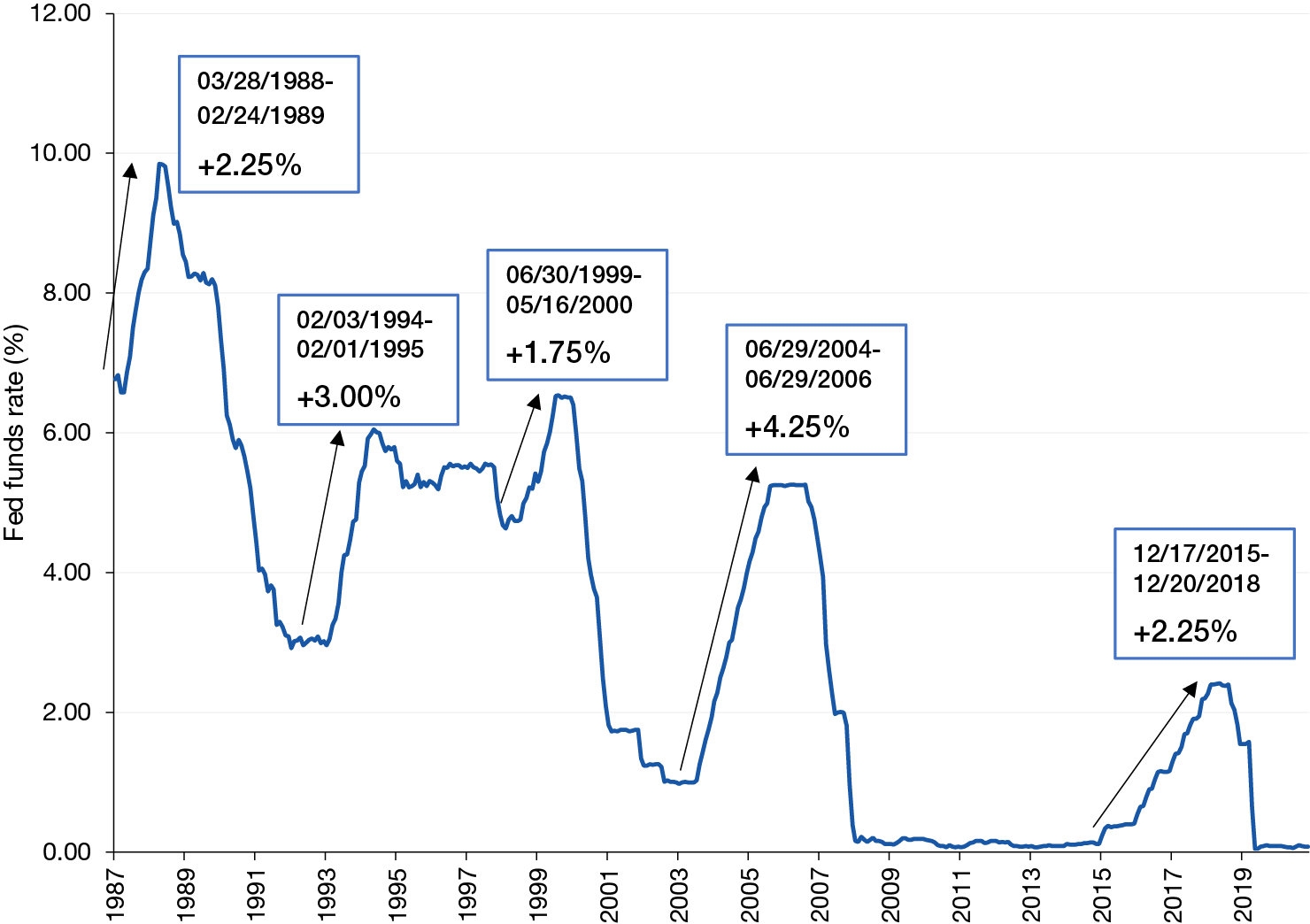

2 according to economists polled by Reuters who said the central bank. The Fed had cut rates in mid-2003 putting the fed funds target rate at 1. The Federal Reserve imposed the latest in a series of sharp interest rate hikes on Wednesday in a sign that policymakers arent backing down from an aggressive campaign to.

How will it affect mortgages credit cards and auto loans The Fed as widely expected raised its key short-term rate by three-quarters of a percentage point to a. The tool allows users to calculate the likelihood of an upcoming. Along with the massive rate increases Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

After the dot-com recession of the early 2000s the US. The Federal Reserve looks on track to extend its aggressive interest-rate hikes even further than previously anticipated after another. Fed Chairman Jerome Powell hinted at stepping off the gas in the future but.

Our fed watch tool displays a forecast estimation for fed hikes or cut by the next upcoming FOMC meeting. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate. Federal Reserve will go for its fourth consecutive 75 basis point interest rate hike on Nov.

Chart The Fed Is Moving Historically Fast To Tame Inflation Statista

How The Stock Market Has Performed During Fed Rate Hike Cycles

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

Fed Barrels Toward Another 75 Basis Point Rate Hike As High Inflation Persists Fox Business

Globaldata Fed S July Rate Hike Of 75 Basis Points Will Slow Us Economic Growth To 2 3 In 2022 Down From Prior Forecast Of 3 6 2022 Inflation Rate Forecast Raised To 7 7 From

Fed Rate Hikes And Recessions Horan

With Inflation Offsides The Fed Keeps Hiking Charles Schwab

Fed Rate Hikes Expectations And Reality Benzinga

With Federal Reserve Poised For Another 75 Bp Rate Hike What S Next Seeking Alpha

Another Monster Rate Hike Is On The Way Etf Com

A History Of Fed Leaders And Interest Rates The New York Times

Stocks Fell Right After Fed Raised Interest Rates Will This Continue

Federal Reserve Approves Its Third Rate Hike Of The Year

Which Assets Have Done Well During Fed Rate Hikes

With Inflation Offsides The Fed Keeps Hiking Charles Schwab